In Arizona, as a homeowner whose house has been foreclosed you have a finite amount of time to vacate. If you do not vacate during that time then you can be evicted by the new homeowner.

Non-judicial foreclosure:

Non-judicial foreclosures in Arizona are much faster and less formal than judicial foreclosures. Most residential mortgages and deeds of trust in Arizona include a power-of sale clause that allows the lender to foreclose non-judicially if the borrower defaults on the loan. In a non-judicial foreclosure, the lender follows a specific process outlined in state law and the mortgage agreement. This typically involves giving the borrower notice of default and an opportunity to cure the default.

- Power of Sale Clause: Most residential mortgages and deeds of trust in Arizona include a power of sale clause. This clause allows the lender to foreclose non-judicially if the borrower defaults on the loan.

- Notice Requirements: The non-judicial foreclosure process in Arizona is initiated by the lender providing the borrower with specific notices of default and intent to sell. These notices are typically sent by certified mail and must comply with statutory requirements.

- Trustee Sale: The lender appoints a trustee, who is typically a neutral third party, to oversee the foreclosure process. The trustee is responsible for conducting the foreclosure sale.

- Auction: The property is sold at a public auction, often held on the courthouse steps or at another designated location. The highest bidder at the auction becomes the new owner of the property.

- No Deficiency Judgment: In most cases of non-judicial foreclosure, the lender is prohibited from seeking a deficiency judgment against the borrower. However, there are exceptions, such as if the borrower engaged in fraud or waste.

- Timeline: Non-judicial foreclosures in Arizona are typically faster and less formal than judicial foreclosures. The timeline can vary but is generally quicker, often taking a few months to complete.

- Redemption Period in Non-Judicial Foreclosure: Arizona does not have a statutory right of redemption period after a non-judicial foreclosure sale. (A.R.S. 33-811(E)). In non-judicial foreclosures, the lender can sell the property without court involvement as long as the deed of trust or mortgage includes a power of sale clause. In Arizona, the ownership interest passes to the new buyer at the foreclosure auction! This means that as soon as the house is foreclosed, the former owner is trespassing and the new owner may start the eviction process.

However, after a non-judicial foreclosure, borrowers may try and work out some kind of a deal with the new owner to stay in the house after the foreclosure date. But the new owner isn’t required to allow you to keep living on the property once they’ve purchased the house. For this reason, many home owners who are losing their house to foreclosure will vacate prior to the auction date. Additionally, all personal property located in the property at the time of the foreclosure auction becomes the property of the new owner and the former owner may have no rights to remove them.

Judicial Foreclosures in Arizona

- Lawsuit Initiation: Judicial foreclosures in Arizona involve a lawsuit filed by the lender (typically the mortgage holder or beneficiary) against the borrower to obtain a court-ordered foreclosure sale.

- Court Involvement: The entire judicial foreclosure process is carried out through the court system. The lender files a complaint in court, and the borrower is served with a summons and complaint, giving them an opportunity to respond to the lawsuit.

- Court Decision: If the court finds in favor of the lender, it will issue a judgment of foreclosure and specify the terms of the foreclosure sale. This judgment specifies the terms of the foreclosure sale, including the date and location of the auction.

- Auction: The property is then sold at a public auction, and the proceeds from the sale are used to satisfy the debt. If the sale does not cover the entire debt, the borrower will likely be protected by Arizona’s anti-deficiency statute.

- Redemption Period in Judicial Foreclosure: A redemption period refers to the window of time in which a borrower can reclaim their foreclosed property by paying off what they owe on the loan and any other delinquent debt attached under the loan agreement. In Arizona, only properties that went through the judicial foreclosure process are eligible for a redemption period. If you meet these conditions, then you have six months from the date of the foreclosure sale to pay all outstanding loan amounts, fees, and costs to redeem the property. However, if the foreclosure occurs out of court, in a nonjudicial foreclosure, then there is no right to redeem the property.

ARIZONA RENTERS WITH LEASE AGREEMENTS

- Arizona renters with a valid month-to-month lease may remain in the foreclosed property for up to 30 days from the date of the foreclosure.

- Arizona renters with valid leases can stay in the foreclosed property until the termination of their lease. For example, if an Arizona renter has a lease that ends September 30, 2023, and a new property owner takes possession of the property May 1, 2023, the Arizona renter may remain in the home until September 30, 2023.

Exception to this Rule. The exception to this rule occurs when the new Arizona owner intends to move into the foreclosed property and make it their primary residence. In that case, the renter may NOT live in the foreclosed property for more than 90 days from the date of foreclosure.

eviction of former owner after foreclosure

Step One- Mail Notice to the Former Owners. Must be sent via certified mail.

Step Two- File a Forcible Detainer in Superior Court. My be filed in the Superior court, unlike typical evictions where they are filed in the Justice court.

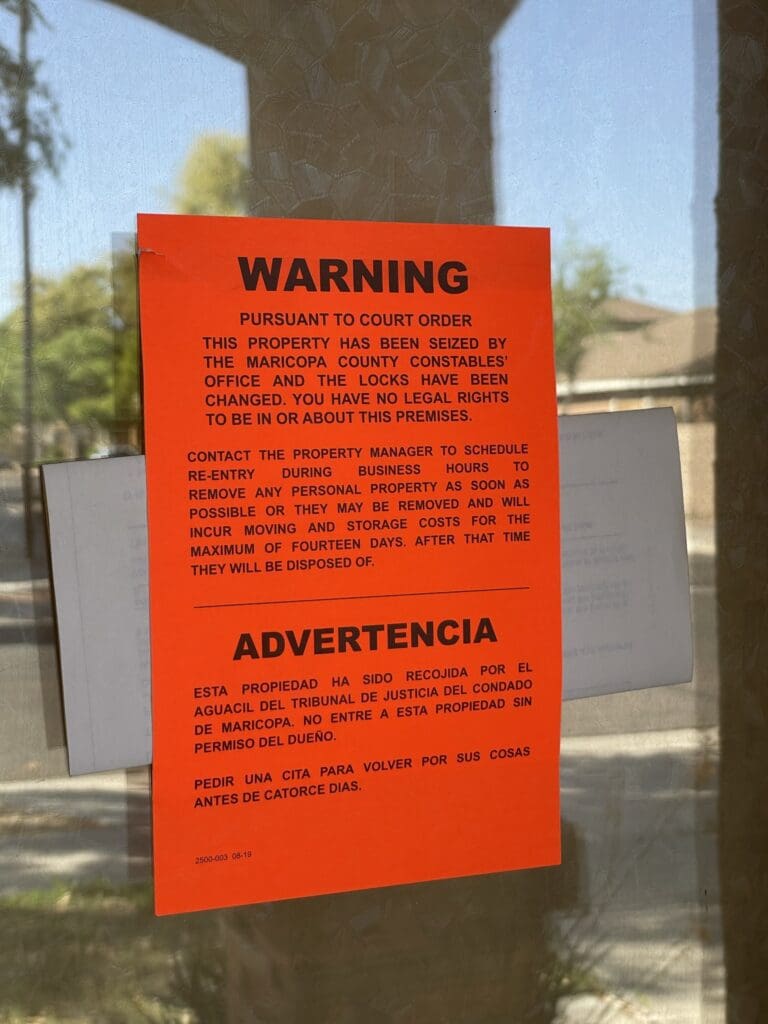

Step Five- Writ of Restitution Against the Former Property Owners.

**The following paragraphs only apply to the eviction of the former owners of residential property lost to foreclosure in Maricopa County Arizona. For information on Writs of Restitution in traditional eviction cases click HERE. **

Former Owner’s Belongings Must Be Removed Prior to Writ. In Maricopa County, the new property owner is required to move the former owner’s belongings out of the property before the Maricopa County Sheriff’s Office (MCSO) will execute the Writ of Restitution. The new property owner must hire hire licensed and bonded movers with truck(s) capable of handling all of the occupants’ personal property. The new property owner must also pay for one month’s storage at an insured storage facility.

The occupants, former owners, do not have a contractual obligation to pay rent, rather they are unauthorized occupants that refuse to vacate. Although it is common for a judgment to include a monetary component for rents owed, that is a statutory result that is not based on a default of the lease.

It can be frustrating to new owners who are required to go through the normal eviction process, but then are not allowed to obtain a writ in the traditional way. The MCSO will not execute a writ against a former property owner under these strict rules are met with precision.

The MCSO does not provide a checklist or how-to instructions for new property owners and so we have created one from our experiences and conversations with the MCSO.

Step By Step Instructions for Coordinating the Execution of the Writ as a new property owners.

- A deputy will contact the former owners/occupants and ask them to vacate the property in order to avoid the move-out/lock-out. The deputy provides them with a copy of the deed and writ and explains that they can move out voluntarily or they will be forcefully removed.

- The deputy will give the occupants reasonable time to move all of their property so the property owner does not have to do so. The deputy will follow up with the occupants to determine whether they are making progress to voluntarily vacate.

- If the occupants are making progress and demonstrating a good-faith effort to vacate, the deputy may allow them more time to move out on their own. The deputy may grant the occupants a few weeks to move.

- The deputy will apprise the property owner of the occupants’ progress.

- The landlord is free to negotiate a “cash-for-keys” agreement with the occupants to encourage a voluntary move-out prior to a move-out/lock-out. In this scenario the property owner MUST NOT enter into a lease agreement with the occupants that enables them in the property as tenants. The occupants should be paid only after they have vacated the property and removed all of their personal property.

- The property owner must notify the deputy if the occupants move out, so the deputy knows that there is no longer a need to execute the writ of restitution.

- If the occupants refuse to voluntarily vacate then the deputy will show up to supervise the move-out process on a designated date. The deputy will coordinate a move-out date with the occupants.

- The deputy will show up at 8 a.m. on the move-out date and give the occupants approximately 30 minutes to pack up essentials and leave. The deputy will discuss with the occupants what personal property can and cannot be removed.

- If the occupants will not leave at that time, they will be escorted from the property by law enforcement.

- Once the former occupants are escorted from the property, the property owner is then free to take physical possession of their property.

- The property owner is required to complete the move-out done in a single day! This means the property owner must figure out the logistics of the move. The deputy will NOT execute the writ if the move-out is incomplete or is not done correctly. The writ gets served on the property after the house is cleared out and the occupants’ personal property is secured in a storage facility.

- The deputy will oversee the removal of the property to ensure that the occupants’ personal property is properly packed for transportation. The deputy will assist in determining whether something is trash or could reasonably be considered personal property.

- The property owner must hire licensed/bonded movers to pack and move the occupants’ personal property. FYI, the MCSO Judicial Enforcement Division will NOT work with AZ Moves for Less b/c they have a history of doing a bad job. It is important to hire a reputable moving company that will do it right the first time.

- The deputy will stop the move-out if he determines that the movers do not appear capable of getting the move complete in one day or if they are doing such a lousy job that the occupants’ property is at risk of damage.

- The deputy will NOT start the move-out if he determines that there are insufficient movers to pack up the house or if there is not sufficient transportation to move all the occupants’ personal property to storage. It is very important to have enough movers, a large enough moving truck (possibly multiple trucks), and a large enough storage unit to contain all the property.

- Movers are required to pack up and move anything that can reasonably be moved. This may include furniture, pictures on the wall, appliances, etc. Movers may be required to move large and heavy items. Anything not hard-wired and/or affixed should be moved.

- Movers are not required to move food and perishable items. Movers are not permitted to remove fixtures, cabinets, doors, ceiling fans, etc.

- The belongings must be transported to an insured storage facility. The property owner is required to pay for one full month of storage (30 days). The storage unit must be put in the occupants’ names so they may retrieve their property from the unit.

- The occupants are responsible for retrieving their property before the 30 days ends. The occupants are responsible to pay for any extension of storage time.

- The deputy will stay only a reasonable amount of time in the evening to complete the move-out. Movers do not have until midnight to finish the move should try to have the move completed during business hours or as close as possible.

- The deputy will execute the writ when the house is empty, and the occupants’ belongings are in storage.

- The locks can be changed upon execution of the writ.

- Defendants are NOT allowed to return to the property for any reason after execution of the writ. They will be considered criminal trespassers and can be arrested.

If you recently purchased an Arizona property at foreclosure and have questions about the occupancy of the former owner, then then contact the Dunaway Law Group at 480-702-1608 or message us HERE.

The Dunaway Law Group provides this information as a service to clients and other friends for educational purposes only. It should not be construed or relied on as legal advice and does not create a lawyer-client or attorney-prospective client relationship. Readers should not act upon this information without seeking advice from professional advisers. Additionally, this Firm limits its practice to the states of Arizona and New York